Mortgage Rates Break From Weeks of Increases – Based on Freddie Mac reports, after four weeks of rate increases, fixed-rate mortgages posted a drop. Rates remain well below their averages from a year ago, and Freddie Mac predicts that will be a boon to home sales over the next couple of months. This comes after the Federal Reserve voted recently not to increase its benchmark rate. “Slightly weaker inflation and labor economic data caused mortgage rates to dip this week,” says Sam Khater, Freddie Mac’s chief economist. “Moving into summer, we expect rates to be about a quarter to half a percentage point lower than where they were last year, which is good news for the housing market. These lower rates combined with solid economic growth, low inflation, and rebounding customer confidence should provide a solid foundation for home sales to continue to improve over the next couple of months.”

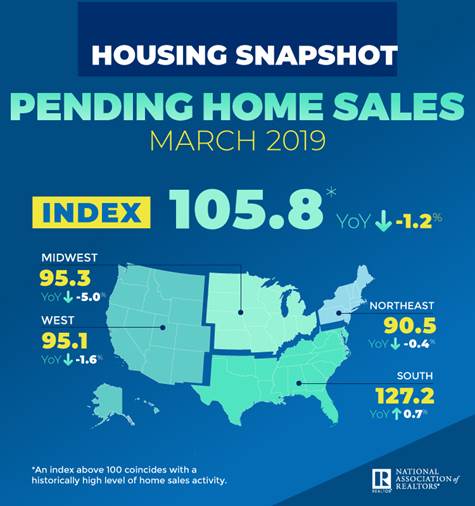

Spring Sales Pick Up: Contract Signings Rebound – According to the National Association of REALTORS®, pending home sales were back on track last month, reversing course after last month’s drop. Three of the four major regions saw an uptick in contract signs in March. NAR’s Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 3.8 percent last month over February, and contract signings reached a reading of 105.8. Still, contract signings are down 1.2 percent year over year, marking the 15th consecutive month of annual decreases. Pending home sales have been volatile in recent months. However, NAR’s Chief Economist Lawrence Yun predicts the numbers to begin climbing more consistently. “We are seeing a positive sentiment from consumers about homebuying, as mortgage applications have been steadily increasing and mortgage rates are extremely favorable,” Yun says.

Average Homeowners Stay 8 Years Before Moving – Based on reports from ATTOM Data Solutions, homeowners have been less transient the last few years. In the first quarter of 2019, homeowners who sold their homes had owned them an average of 8.05 years, down slightly from a record high of 8.17 in the fourth quarter of 2018. Prior to the Great Recession, from the first quarter of 2000 to the third quarter of 2007, homeownership tenure averaged just 4.21 years. Homeowners who stay longer are seeing higher gains at resale. In the first quarter of this year, home sellers pocketed an average price gain of $57,500 since their purchase, which is an average 31.5% return on the purchase price, ATTOM Data Solutions reports.

A Good Year for Employee Relocations – According to Atlas Van Lines’ Corporate Relocation Survey, corporate relocation volumes and budgets are increasing, helping employees to more easily make a move for a job. In particular, 60% of mid-size firms with 500 to 4,999 salaried employees reported relocation budget increases. For comparison, about 40% of small firms (fewer than 500 salaried employees) and 40% of large firms (5,000-plus) saw employee relocations increase over the past year. Companies are optimistic that 2019 will be a good year for relocations. Overall, more than 40% of organizations say they expect increases in relocation volume and budgets this year, and they’re using multiple employee reimbursement methods for moves. Full reimbursement for new hires (36%) remains near historically low levels, the survey shows. On the other hand, lump-sum payments to cover costs of a move are most popular (56%). Lump-sum payments have increased in popularity and are now offered with about the same frequency to new hires and transfers, according to the study.